Jump to page sections

Here I describe how I calculate the trend for financial products, indices/indexes, etc. It can really be used for any kind of numbers where you want a trend analysis. Incidentally, I originally wrote a version of this to calculate when computer disk storage space in an enterprise would reach 0 on various components/drives.

I use trend-line mathematical analysis of the numbers. This was written by Joakim Borger Svendsen, head of

Svendsen Tech.

Below are examples of analysis now during the tumultous and unusual times in March 2020, when Covid-19 is rampant, also known as the Corona virus.

The VIX fear index, measuring volatility (fluctuations in price), has skyrocketed recently and is at the highest since February 2009 right now on March 6, 2020.

NB! These are simply indicators and based on nothing but math and close rates, so make sure you're aware of that!

It will exaggerate the current trend.

The code I use is open source and published on

GitHub here.

I use financial data from Yahoo. The code works unaltered against it as per 2020-03-06.

Calculate the Trend for the SnP500 Index

Example analysis from March 6, 2020. SnP500 is closed now as I'm writing this at 10 PM / 22:00 GMT. Nasdaq is still kicking, apparently (see below).

PS C:\temp> Get-SnP500Trend -FilePath .\^GSPC.csv

# Close rates back in time.

Date Rate Count

---- ---- -----

2020-02-05 3334.689941 1

2020-02-06 3345.780029 2

2020-02-07 3327.709961 3

2020-02-10 3352.090088 4

2020-02-11 3357.750000 5

2020-02-12 3379.449951 6

2020-02-13 3373.939941 7

2020-02-14 3380.159912 8

2020-02-18 3370.290039 9

2020-02-19 3386.149902 10

2020-02-20 3373.229980 11

2020-02-21 3337.750000 12

2020-02-24 3225.889893 13

2020-02-25 3128.209961 14

2020-02-26 3116.389893 15

2020-02-27 2978.760010 16

2020-02-28 2954.219971 17

2020-03-02 3090.229980 18

2020-03-03 3003.370117 19

2020-03-04 3130.120117 20

2020-03-05 3023.939941 21

# Predictions ahead (-21 for each number for how many predictions ahead).

2020-03-06 3003,129475 22

2020-03-06 2982,264134 23

2020-03-06 2961,357041 24

2020-03-06 2940,417798 25

2020-03-06 2919,453528 26

2020-03-06 2898,469579 27

2020-03-06 2877,470011 28

2020-03-06 2856,457941 29

2020-03-06 2835,435783 30

2020-03-06 2814,405424 31

2020-03-06 2793,368352 32

2020-03-06 2772,325750 33

2020-03-06 2751,278564 34

2020-03-06 2730,227556 35

2020-03-06 2709,173346 36

2020-03-06 2688,116438 37

2020-03-06 2667,057247 38

2020-03-06 2645,996115 39

2020-03-06 2624,933325 40

2020-03-06 2603,869114 41

2020-03-06 2582,803680 42

Calculate the trend for the NASDAQ 100 Composite Index

Here's 50 samples back and 10 predictions ahead (exaggerated trend) for the NASDAQ 100 composite index as of 2020-03-06. The name of the function is misnomered in retrospect (damn retrospect), but I specify the "^NDX" paper, so it handles the NASDAQ data I download from

Yahoo here.

PS C:\temp> Get-SnP500Trend -FilePath .\^NDX.csv -SamplesBackCount 50 -PredictionsAheadCount 10 |

select -Last 30

Date Rate Count

---- ---- -----

2020-02-06 9445.919922 31

2020-02-07 9401.099609 32

2020-02-10 9516.839844 33

2020-02-11 9517.860352 34

2020-02-12 9613.200195 35

2020-02-13 9595.700195 36

2020-02-14 9623.580078 37

2020-02-18 9629.799805 38

2020-02-19 9718.730469 39

2020-02-20 9627.830078 40

2020-02-21 9446.690430 41

2020-02-24 9079.629883 42

2020-02-25 8834.870117 43

2020-02-26 8873.759766 44

2020-02-27 8436.669922 45

2020-02-28 8461.830078 46

2020-03-02 8877.980469 47

2020-03-03 8594.490234 48

2020-03-04 8949.280273 49

2020-03-05 8671.660156 50

# Predictions for NASDAQ start here. -50 for each prediction count ahead.

2020-03-06 8677,729847 51

2020-03-06 8682,548889 52

2020-03-06 8686,256142 53

2020-03-06 8688,972807 54

2020-03-06 8690,804947 55

2020-03-06 8691,845610 56

2020-03-06 8692,176621 57

2020-03-06 8691,870105 58

2020-03-06 8690,989777 59

2020-03-06 8689,592046 60

Visit the aforementioned

GitHub link to get the code and some more information, but the threshold for using the tool is quite high. My apologies. :)

Calculate the Trend for the Dow Jones Index

And here's 30 samples back and 10 predictions ahead for the Dow Jones index as of today.

PS C:\temp> Get-SnP500Trend -FilePath .\^DJI.csv -SamplesBackCount 30 -PredictionsAheadCount 10 |

select -Last 30

Date Rate Count

---- ---- -----

2020-02-06 29379.769531 11

2020-02-07 29102.509766 12

2020-02-10 29276.820313 13

2020-02-11 29276.339844 14

2020-02-12 29551.419922 15

2020-02-13 29423.310547 16

2020-02-14 29398.080078 17

2020-02-18 29232.189453 18

2020-02-19 29348.029297 19

2020-02-20 29219.980469 20

2020-02-21 28992.410156 21

2020-02-24 27960.800781 22

2020-02-25 27081.359375 23

2020-02-26 26957.589844 24

2020-02-27 25766.640625 25

2020-02-28 25409.359375 26

2020-03-02 26703.320313 27

2020-03-03 25917.410156 28

2020-03-04 27090.859375 29

2020-03-05 26121.279297 30

# Predictions ahead start here (-30 for each prediction count ahead):

2020-03-06 26024,340165 31

2020-03-06 25922,731828 32

2020-03-06 25817,276702 33

2020-03-06 25708,633062 34

2020-03-06 25597,331434 35

2020-03-06 25483,802158 36

2020-03-06 25368,396441 37

2020-03-06 25251,402555 38

2020-03-06 25133,058403 39

2020-03-06 25013,561333 40

Where are we?

If you're wondering how the developments have been recently, and not so recently, then it's handy to use my "Get-PeriodicDevelopment" function.

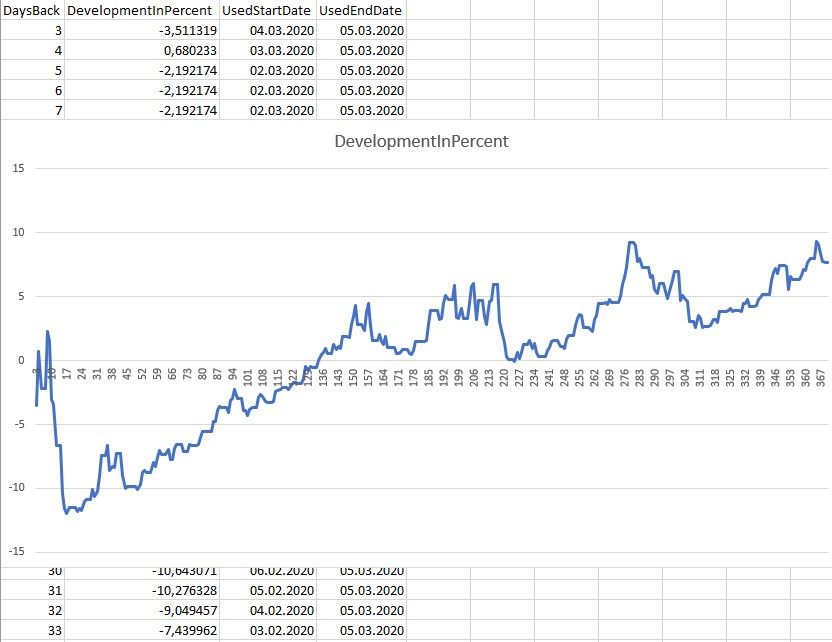

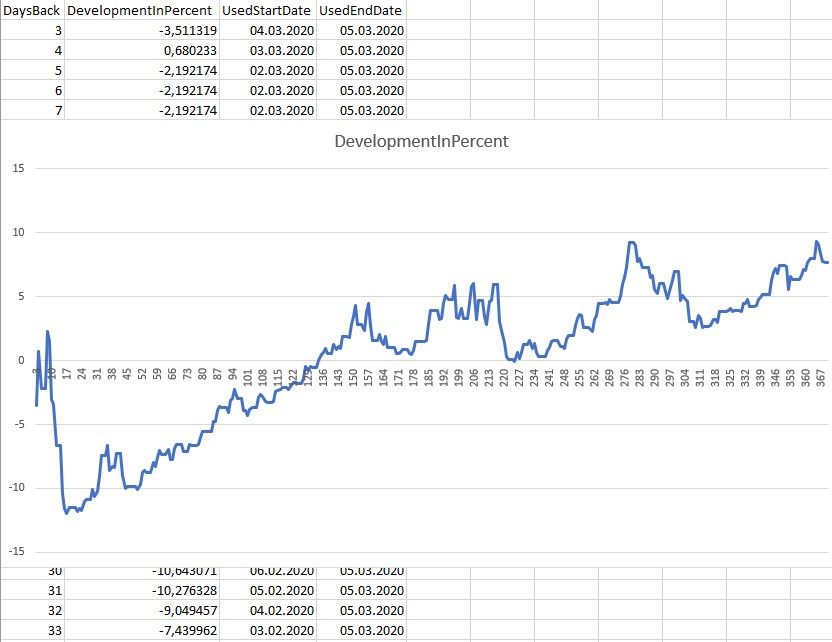

Here's an example where I analyse the SnP500 index and have a look a year back in time. If you look at the "370" entry, you can see that we're up 7 % since March 4, 2019. The corrections we're seeing are still relatively small historically, and circumstances are now indeed highly unusual.

PS C:\temp> . .\Get-PeriodicDevelopment.ps1

3..370 | where { $_ % 5 -eq 0 } | foreach {

$Development = Get-PeriodicDevelopment -FilePath C:\temp\^GSPC.csv -StartDate (Get-Date).AddDays(-1 * $_) -EndDate (get-date).AddDays(-2)

[PSCustomObject] @{

DaysBack = $_

DevelopmentInPercent = [Math]::Round($Development.PercentDevelopment, 6)

UsedStartDate = $Development.UsedStartDate.ToString('yyyy\-MM\-dd')

UsedEndDate = $Development.UsedEndDate.ToString('yyyy\-MM\-dd')

}

} | ft

DaysBack DevelopmentInPercent UsedStartDate UsedEndDate

-------- -------------------- ------------- -----------

5 -2,192174 2020-03-02 2020-03-05

10 -3,057268 2020-02-26 2020-03-05

15 -10,377523 2020-02-21 2020-03-05

20 -11,453604 2020-02-18 2020-03-05

25 -11,038912 2020-02-11 2020-03-05

30 -10,643071 2020-02-06 2020-03-05

35 -7,439962 2020-02-03 2020-03-05

40 -7,265023 2020-01-27 2020-03-05

45 -9,848412 2020-01-22 2020-03-05

50 -10,108672 2020-01-17 2020-03-05

55 -8,736613 2020-01-13 2020-03-05

60 -7,051727 2020-01-07 2020-03-05

65 -7,735278 2020-01-02 2020-03-05

70 -6,526257 2019-12-30 2020-03-05

75 -6,616205 2019-12-23 2020-03-05

80 -5,529209 2019-12-18 2020-03-05

85 -4,790443 2019-12-13 2020-03-05

90 -3,704439 2019-12-09 2020-03-05

95 -2,290390 2019-12-03 2020-03-05

100 -3,870449 2019-11-29 2020-03-05

105 -3,627716 2019-11-25 2020-03-05

110 -3,243784 2019-11-18 2020-03-05

115 -2,318171 2019-11-13 2020-03-05

120 -2,286426 2019-11-08 2020-03-05

125 -1,796665 2019-11-04 2020-03-05

130 -0,428248 2019-10-29 2020-03-05

135 0,451395 2019-10-24 2020-03-05

140 0,569455 2019-10-21 2020-03-05

145 1,911084 2019-10-14 2020-03-05

150 3,457081 2019-10-09 2020-03-05

155 2,378683 2019-10-04 2020-03-05

160 1,560876 2019-09-30 2020-03-05

165 1,896196 2019-09-24 2020-03-05

170 0,567138 2019-09-19 2020-03-05

175 0,859143 2019-09-16 2020-03-05

180 1,504991 2019-09-09 2020-03-05

185 2,849260 2019-09-04 2020-03-05

190 3,223608 2019-08-30 2020-03-05

195 4,813590 2019-08-26 2020-03-05

200 4,081759 2019-08-20 2020-03-05

205 5,831460 2019-08-15 2020-03-05

210 4,670727 2019-08-12 2020-03-05

215 5,926042 2019-08-05 2020-03-05

220 1,440507 2019-07-31 2020-03-05

225 -0,063499 2019-07-26 2020-03-05

230 1,286729 2019-07-22 2020-03-05

235 0,658079 2019-07-16 2020-03-05

240 0,794660 2019-07-11 2020-03-05

245 1,587002 2019-07-08 2020-03-05

250 1,971265 2019-07-01 2020-03-05

255 3,642927 2019-06-26 2020-03-05

260 2,429942 2019-06-21 2020-03-05

265 4,440234 2019-06-17 2020-03-05

270 4,570857 2019-06-11 2020-03-05

275 5,967379 2019-06-06 2020-03-05

280 9,242577 2019-06-03 2020-03-05

285 7,326536 2019-05-28 2020-03-05

290 5,544750 2019-05-22 2020-03-05

295 5,436944 2019-05-17 2020-03-05

300 7,013030 2019-05-13 2020-03-05

305 4,626080 2019-05-07 2020-03-05

310 3,519247 2019-05-02 2020-03-05

315 2,675645 2019-04-29 2020-03-05

320 3,835062 2019-04-22 2020-03-05

325 4,083745 2019-04-17 2020-03-05

330 3,853583 2019-04-12 2020-03-05

335 4,238507 2019-04-08 2020-03-05

340 5,181980 2019-04-02 2020-03-05

345 6,894978 2019-03-28 2020-03-05

350 7,459799 2019-03-25 2020-03-05

355 6,316263 2019-03-18 2020-03-05

360 7,044453 2019-03-13 2020-03-05

365 9,288209 2019-03-08 2020-03-05

370 7,643336 2019-03-04 2020-03-05

Volatility in the NASDAQ Index is Higher

If we run the same example code against the NASDAQ index, we see the growth is bigger, at 17 % compared to 370 days back and the closest stock market day match to that day, March 4, 2019.

This uses the function Get-PeriodicDevelopment which I "dot-source" first to load/import it in the current session. Hold down shift when you press enter to spread a command over multiple lines...

PS C:\temp> . .\Get-PeriodicDevelopment.ps1

3..370 | where { $_ % 5 -eq 0 } | foreach {

$Development = Get-PeriodicDevelopment -FilePath c:\temp\^NDX.csv -StartDate (Get-Date).AddDays(-1 * $_) -EndDate (get-date).AddDays(-2)

[PSCustomObject] @{

DaysBack = $_

DevelopmentInPercent = [Math]::Round($Development.PercentDevelopment, 6)

UsedStartDate = $Development.UsedStartDate.ToString('yyyy\-MM\-dd')

UsedEndDate = $Development.UsedEndDate.ToString('yyyy\-MM\-dd')

}

} | ft

DaysBack DevelopmentInPercent UsedStartDate UsedEndDate

-------- -------------------- ------------- -----------

5 -2,379248 2020-03-02 2020-03-05

10 -2,330576 2020-02-26 2020-03-05

15 -8,937507 2020-02-21 2020-03-05

20 -11,049091 2020-02-18 2020-03-05

25 -9,758226 2020-02-11 2020-03-05

30 -8,928622 2020-02-06 2020-03-05

35 -5,242022 2020-02-03 2020-03-05

40 -3,234900 2020-01-27 2020-03-05

45 -5,961026 2020-01-22 2020-03-05

50 -5,789783 2020-01-17 2020-03-05

55 -4,601082 2020-01-13 2020-03-05

60 -2,015647 2020-01-07 2020-03-05

65 -2,312816 2020-01-02 2020-03-05

70 -0,439020 2019-12-30 2020-03-05

75 -0,280795 2019-12-23 2020-03-05

80 1,049857 2019-12-18 2020-03-05

85 2,121280 2019-12-13 2020-03-05

90 3,562408 2019-12-09 2020-03-05

95 4,807844 2019-12-03 2020-03-05

100 3,090302 2019-11-29 2020-03-05

105 3,456437 2019-11-25 2020-03-05

110 3,957485 2019-11-18 2020-03-05

115 4,749386 2019-11-13 2020-03-05

120 4,794590 2019-11-08 2020-03-05

125 5,316168 2019-11-04 2020-03-05

130 7,197588 2019-10-29 2020-03-05

135 8,129239 2019-10-24 2020-03-05

140 8,433565 2019-10-21 2020-03-05

145 9,563683 2019-10-14 2020-03-05

150 11,314216 2019-10-09 2020-03-05

155 10,581135 2019-10-04 2020-03-05

160 10,634757 2019-09-30 2020-03-05

165 11,089227 2019-09-24 2020-03-05

170 8,878001 2019-09-19 2020-03-05

175 9,447441 2019-09-16 2020-03-05

180 9,678196 2019-09-09 2020-03-05

185 10,983020 2019-09-04 2020-03-05

190 11,308794 2019-08-30 2020-03-05

195 12,646254 2019-08-26 2020-03-05

200 11,614730 2019-08-20 2020-03-05

205 13,685615 2019-08-15 2020-03-05

210 12,800086 2019-08-12 2020-03-05

215 14,483619 2019-08-05 2020-03-05

220 9,489306 2019-07-31 2020-03-05

225 7,549996 2019-07-26 2020-03-05

230 8,839600 2019-07-22 2020-03-05

235 8,586361 2019-07-16 2020-03-05

240 8,935779 2019-07-11 2020-03-05

245 10,215692 2019-07-08 2020-03-05

250 10,419228 2019-07-01 2020-03-05

255 12,046256 2019-06-26 2020-03-05

260 10,873124 2019-06-21 2020-03-05

265 13,205547 2019-06-17 2020-03-05

270 13,351654 2019-06-11 2020-03-05

275 16,095303 2019-06-06 2020-03-05

280 19,530749 2019-06-03 2020-03-05

285 16,067053 2019-05-28 2020-03-05

290 14,426303 2019-05-22 2020-03-05

295 13,468932 2019-05-17 2020-03-05

300 15,539473 2019-05-13 2020-03-05

305 11,895188 2019-05-07 2020-03-05

310 10,927551 2019-05-02 2020-03-05

315 9,601623 2019-04-29 2020-03-05

320 11,049440 2019-04-22 2020-03-05

325 11,427338 2019-04-17 2020-03-05

330 12,033570 2019-04-12 2020-03-05

335 12,361185 2019-04-08 2020-03-05

340 13,515521 2019-04-02 2020-03-05

345 15,581675 2019-03-28 2020-03-05

350 15,622155 2019-03-25 2020-03-05

355 15,514681 2019-03-18 2020-03-05

360 16,313833 2019-03-13 2020-03-05

365 19,096346 2019-03-08 2020-03-05

370 17,537934 2019-03-04 2020-03-05

Graph of Percent-wise Development of the SnP500 Index from Back in Time to Today

We need a graph or it's no fun. This basically shows the down trend is recent... This is the SnP500 Index again.

Powershell

Windows

Finance

Finans

Fintech

SnP500

NASDAQ

DowJones

Math

Powershell

Windows

Finance

Finans

Fintech

SnP500

NASDAQ

DowJones

Math

Blog articles in alphabetical order

Powershell

Windows

Finance

Finans

Fintech

SnP500

NASDAQ

DowJones

Math

Powershell

Windows

Finance

Finans

Fintech

SnP500

NASDAQ

DowJones

Math