Jump to page sections

In this article you will find an historical view of the SnP 500 Index, and access to the code to produce it yourself, available on

GitHub here. Here I use 14-day periods and the bottom list for the 7-day periods is shown. 2020 makes an appearance if you exclude years before 1970.

I won't say or conclude much, but just present the numbers and the tool to acquire the same knowledge. I should optimize it as it took about 3 hours or so to process from December 1927 to today. I use

the Yahoo financial data here, available for free. (Not anymore

as of 2021-10-28).

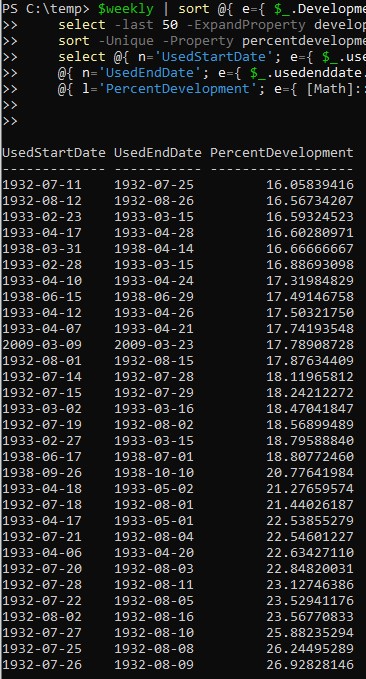

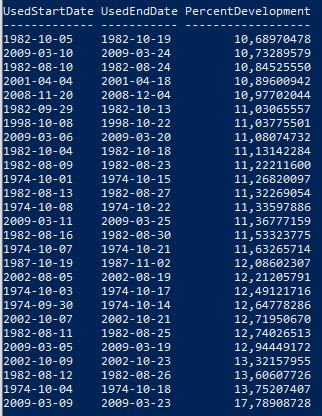

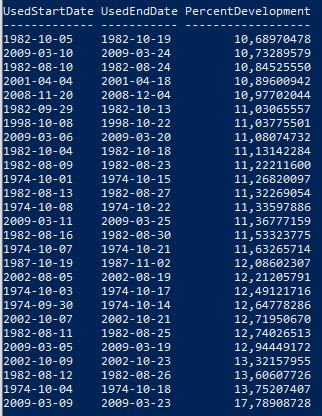

The best SnP 500 index 14-day periods ever

I took every SnP 500 14-day period (or as close as possible, according to my algorithm) from December 30, 1927 to March 13, 2020 and pulled out the best ones. With my current code and method it will take about 3 hours for each time period you want to calculate for, so if I want to know the 7-day trend, I will have to re-run the code that populates the variable "$weekly" and change to subtract 7 days instead of 14. It occurs to me that I could use a 1-day interval and aggregate the results with post-processing to calculate all other intervals, based on that. It might not even be faster though, I haven't thought it through.

Incidentally, I read that yesterday represented the worst 18-day streak in history (March 16, 2020), without calculating myself, which is what gave me the idea to write this. Apparently, we have not yet hit the worst 14-day streak in history if my calculations are to be trusted.

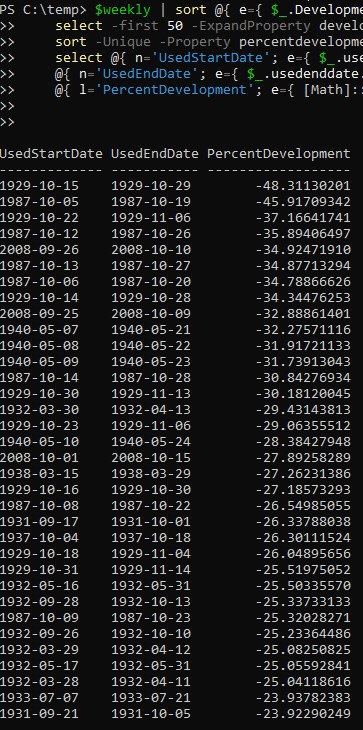

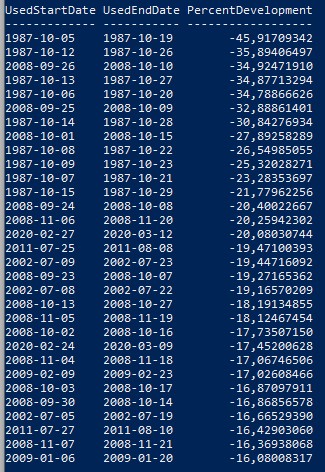

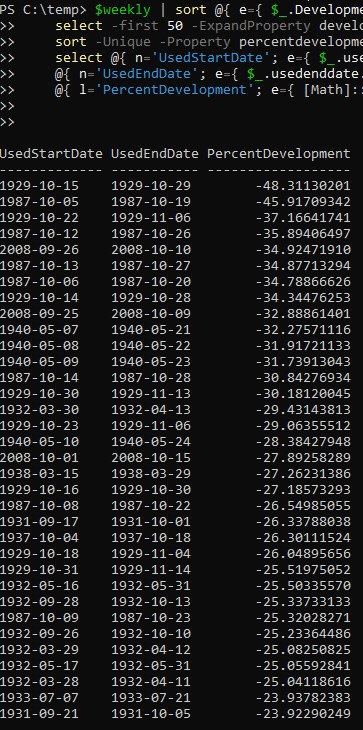

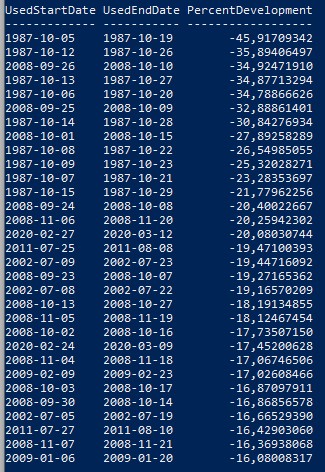

The worst SnP 500 index 14-day periods ever

This shows the worst 14-day periods in history on the US SnP500 Index from December 30, 1927 to March 16, 2020.

We see the 2008 crash represented twice, the 1987 crash, and a lot of crazy around 1929 and going forward.

We also see that 2020 isn't included yet, but as I mentioned above, I read that March 16 represented the worst 18-day period since the 1929 crash, so it's a matter of details, most likely.

I clearly see that the code appears to be working as intended, though, by picking out the 1929 + aftermath and the 1987 crash and the 2008 crash.

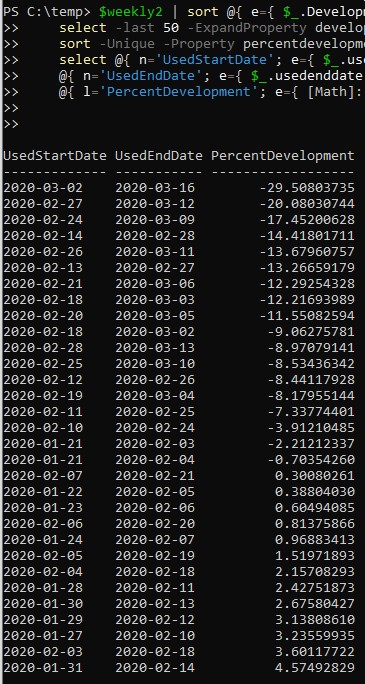

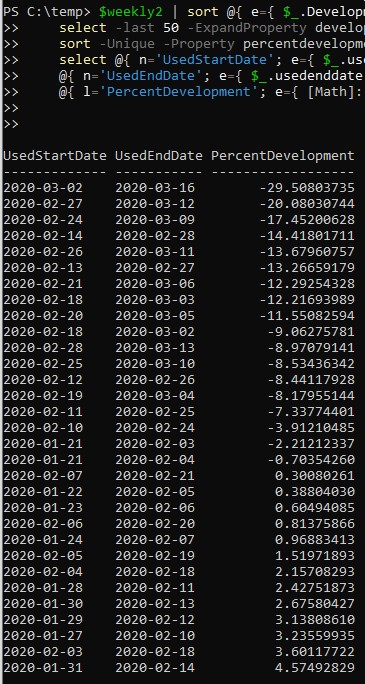

The last two months on the S&P 500 Index

Indeed we see that March 2nd to March 16th 2020 is not so good for the SnP 500 index. Down 29.5 % according to my calculations.

SnP 500 development with years before 1970 excluded, bottom list

Still 14-day intervals of the SnP 500 index. Now I've excluded years before 1970 to inspect more recent times.

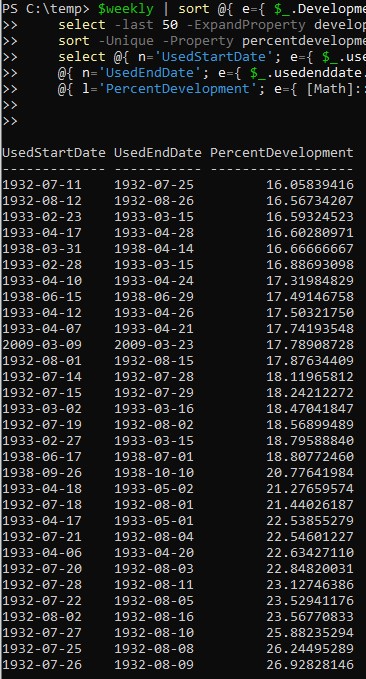

SnP 500 development with years before 1970 excluded, top list

Here's the top list in descending order. Still 14-day intervals.

Here's a PowerShell transcript file with some of my session that gives the right people all they need to do the same:

https://github.com/EliteLoser/Finance/blob/master/SnP500/snp500-14-dagers-analyse.txtSnP 500 development with years before 1970 excluded, bottom list, 7 day intervals

Here are 7-day intervals as of March 16, 2020.

UsedStartDate UsedEndDate PercentDevelopment

------------- ----------- ------------------

1987-10-12 1987-10-19 -37,60452789

1987-10-13 1987-10-20 -32,80411533

2008-10-02 2008-10-09 -22,45912276

2008-10-03 2008-10-10 -22,24261198

2020-03-05 2020-03-12 -21,90160892

2008-11-13 2008-11-20 -21,11131460

1987-10-15 1987-10-22 -20,07250232

1987-10-14 1987-10-21 -18,13221035

2008-10-01 2008-10-08 -17,88129801

2008-09-30 2008-10-07 -17,07738257

2008-10-20 2008-10-27 -16,07690286

2020-03-09 2020-03-16 -15,10522032

2011-08-01 2011-08-08 -14,96078340

2020-03-04 2020-03-11 -14,18045840

1987-10-16 1987-10-23 -13,89090761

1998-08-24 1998-08-31 -13,66997974

2020-02-20 2020-02-27 -13,24275768

2020-02-21 2020-02-28 -12,98244656

2002-07-16 2002-07-23 -12,94220740

2020-03-02 2020-03-09 -12,51274007

2011-08-03 2011-08-10 -12,45404500

2015-08-18 2015-08-25 -12,27825610

2002-07-15 2002-07-22 -11,96316642

2008-11-04 2008-11-11 -11,88052579

2008-11-05 2008-11-12 -11,78810670

2000-04-07 2000-04-14 -11,77905217

2015-08-17 2015-08-24 -11,05159936

2009-02-24 2009-03-03 -11,03068892

1987-10-21 1987-10-28 -10,75960481

2008-09-26 2008-10-03 -10,37453873

Finance

Finans

Powershell

Windows

Fintech

Math

Trend

Corona

Blog articles in alphabetical order

Here's a PowerShell transcript file with some of my session that gives the right people all they need to do the same: https://github.com/EliteLoser/Finance/blob/master/SnP500/snp500-14-dagers-analyse.txt

Here's a PowerShell transcript file with some of my session that gives the right people all they need to do the same: https://github.com/EliteLoser/Finance/blob/master/SnP500/snp500-14-dagers-analyse.txt